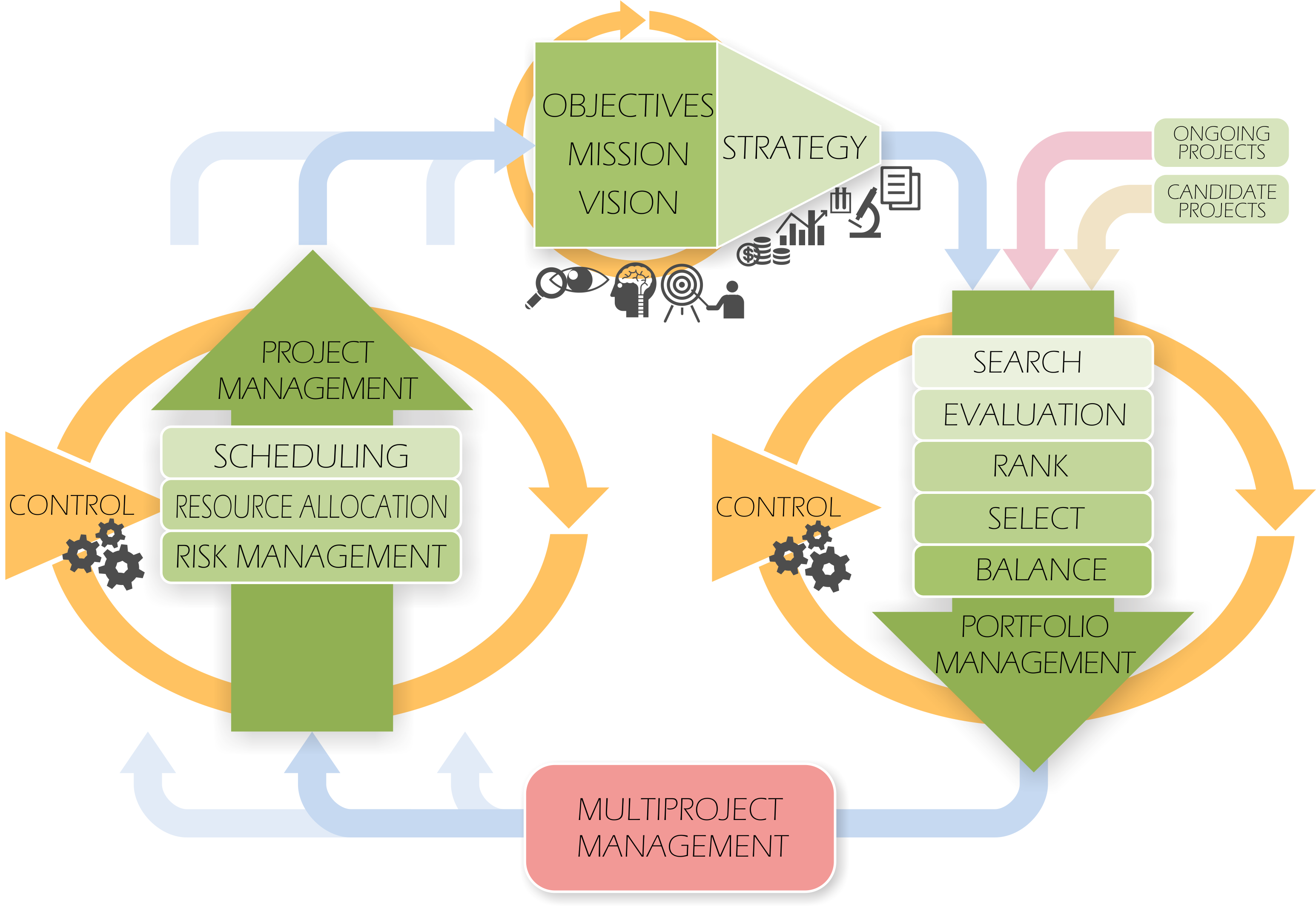

In order to become competitive in a globalized economy, firms needed to define innovative strategies and to translate these strategies into a portfolio of projects. Therefore, Project Portfolio Management (PPM) discipline had become more and more important during the last decade.

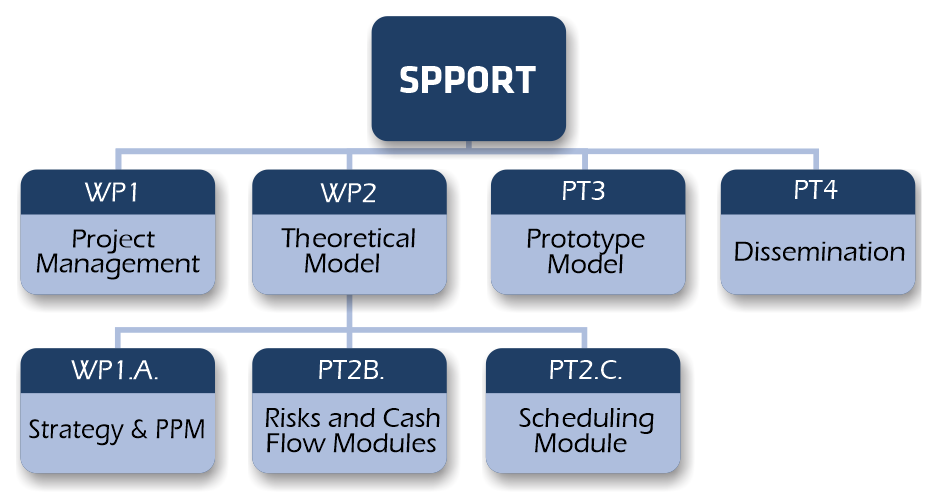

In this R&D project, we developed computational models to help firms to manage their project portfolios, including project selection, prioritization, portfolio balancing, risk management and also more operative issues like project scheduling, resource allocation and portfolio monitoring.

In order to become competitive in a globalized economy, firms needed to define innovative strategies and to translate these strategies into a portfolio of projects. Therefore, Project Portfolio Management (PPM) discipline had become more and more important during the last decade.

In this R&D project, we developed computational models to help firms to manage their project portfolios, including project selection, prioritization, portfolio balancing, risk management and also more operative issues like project scheduling, resource allocation and portfolio monitoring.

Mainstream Project Portfolio Management (PPM) models were concerned with project selection and prioritization, in order to align projects with the strategic objectives of the firm. But most of the models did not take into account how those processes were also related to more operational issues, like project scheduling, the influence of external and internal risks, cash flow and resource interactions among projects, etc. In practice, the integration of the strategic and operational dimensions were quite difficult because of the heterogeneity and complexity of the particular situations that could be found in real projects (delays, new projects, strategy changes, etc.)

We dealt with this complexity by means of an innovative bottom-up approach to Project Portfolio Management, so that we could model real complex situations. To this aim, we used Multi-Agent technologies.

Therefore, our models integrated both the PPM strategic and operational dimensions, helping managers to take real decisions about the portfolio. The main deliverable of the project was a pilot software implementing the new models.

Project results were useful for firms involved in several projects at the same time, as the models helped them to implement their corporate strategy and to optimize resources allocation.

This project was financed by the Regional Government of Castile and Leon: Junta de Castilla y León, reference number: VA056A12-2.

This project was financed by the Regional Government of Castile and Leon: Junta de Castilla y León, reference number: VA056A12-2.